- In today’s rapid-paced economic world, bank declaration verification has turned out to be a vital system for individuals and companies. This text affords a whole review of financial institution declaration verification, which includes how it works, its benefits, strategies, and solutions to regularly asked questions. If you want to apprehend why bank statement verification matters and how to do it efficiently, this guide is for you.

1. What’s a financial institution declaration Verification?

- Bank announcement verification is the method of confirming the accuracy and authenticity of a financial institution assertion supplied by a character or commercial enterprise. This method enables verifying that the details, along with account holder call, account variety, transaction history, and balance, are real and healthy data within the financial institution’s database. It guarantees that the financial facts aren’t solid, altered, or misleading.

2. Why is bank announcement Verification essential?

- The importance of financial institution announcement verification lies in the fact that financial fraud is on the upward push. faux or altered financial institution statements may be used to obtain loans, skip security checks, or manage economic information. With the aid of conducting bank assertion verification, businesses can:

- prevent Fraud: locate faux or tampered statements.

- make certain Compliance: Meet regulatory requirements which includes KYC (know Your patron) and AML (Anti-money Laundering) rules.

- construct consider: hold credibility among financial institutions and clients.

- confirm profits & Transactions: make certain accurate earnings proof for mortgage or employment applications.

3. methods of bank statement Verification

- There are several methods to carry out bank declaration verification, relying on the scenario and assets available:

- a) Direct financial institution confirmation

- That is the maximum reliable method in which the organization immediately contacts the bank to verify the declaration information.

- b) virtual Verification gear

- Fintech companies provide API-based totally bank assertion verification offerings that immediately check the authenticity of a document.

- c) guide cross-Checking

- A manual overview of the bank statement to test for inconsistencies in fonts, formatting, and transaction styles.

- d) OCR (Optical character recognition) Scanning

- advanced OCR gear scan bank statements for records extraction and then cross-check the facts with bank databases.

- e) on-line Banking Portals

- A few verification tactics require login to the applicant’s online banking account for direct confirmation.

- Using more than one strategy together will increase the accuracy of financial institution statement verification.

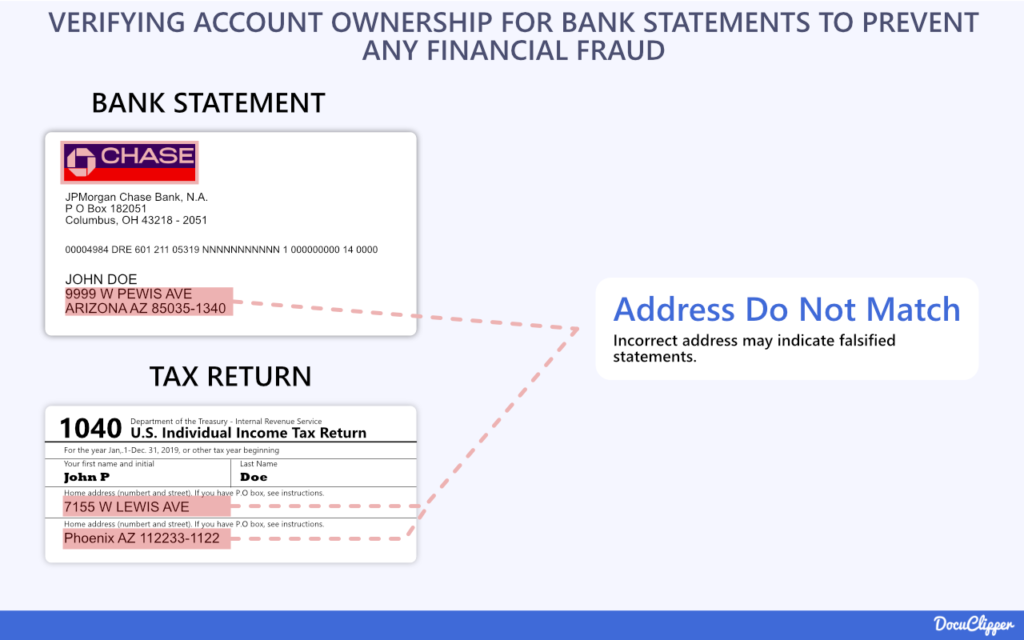

4. common signs of a fake bank statement

- whilst doing financial institution statement verification, be aware of those pink flags:

- Mismatched Fonts & Formatting – authentic financial institution statements have steady layouts.

- incorrect financial institution logos or hues – Minor differences can indicate a fake.

- Suspicious Transactions – irregular styles or unrealistic quantities.

- lacking details – along with bank contact information or official watermarks.

- mistakes in Dates – Overlapping or incorrect dates in transactions.

- Recognizing those signs can help make financial institution declaration verification more green.

5. quality Practices for financial institution announcement Verification

- To make sure a hit financial institution statement verification, comply with these nice practices:

- usually Use reliable assets – touch the bank at once or use trusted verification systems.

- Automate where possible – digital equipment speeds up the verification process.

- hold Confidentiality – protect sensitive banking information always.

- often replace Verification tactics – stay in advance of the latest fraud strategies.

- teach Your crew – make certain employees apprehend the importance of thorough verification.

- by following those steps, financial institution declaration verification may be each relaxed and green.

(FAQs)

- Q1: What’s the purpose of bank statement verification?

- The main reason for financial institution statement verification is to affirm the authenticity and accuracy of financial statistics for preventing fraud and ensuring compliance.

- Q2: How lengthy does bank assertion verification take?

- Relying on this approach, financial institution declaration verification can take anywhere from a few minutes (with digital equipment) to numerous days (manual verification).

- Q3: Am I able to do bank announcement verification online?

- Yes, many financial establishments and fintech groups offer on-line bank declaration verification offerings.

- Q4: Is financial institution assertion verification obligatory for loans?

- In most cases, sure. creditors require financial institution announcement verification to assess the applicant’s monetary records.

- Q5: Are there fees for financial institution statement verification?

- A few banks and third-birthday party providers may also charge a fee for financial institution assertion verification, even as others provide it loosely as part of their carrier.

Conclusion

- Financial institution assertion verification is a critical manner in these days’ economic surroundings. It guarantees that economic records are correct, true, and compliant with rules. Whether you’re an enterprise verifying a consumer’s documents or a character applying for a loan, bank announcement verification protects in opposition to fraud, builds belief, and supports knowledgeable choice-making.